us germany tax treaty withholding rates

Signed the OECD multilateral instrument MLI on July 7 2017. FIRS Terminates Uniform WHT Rate For Residents Of Treaty Countries.

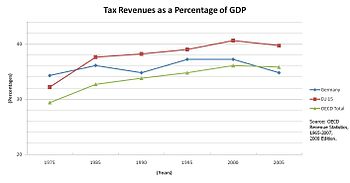

Fin 440 International Finance Ppt Download

The Federal Inland Revenue Service FIRS or the Service has issued a Public Notice informing taxpayers of the termination of the reduced 75 withholding tax WHT rate applicable on dividends interest and royalties earned by taxable persons resident in countries.

. With respect to the capital gains tax the double taxation treaty signed by Germany and the United States provisions that a German company holding real estate in the United States may be taxed in the United States. First to avoid double taxation of income earned by a citizen or resident of one country in the other country. Obligors General Treaty.

Article 10 9 of the US- Germany Income Tax Treaty reduces the branch profits tax to the portion to the dividend equivalent amount The dividend equivalent amount for any year approximates the dividend that a US. Corporate - Withholding taxes. Otherwise the beneficiary can compute a foreign tax credit on Form 1116 of Form 1040.

152 rows Quick Charts Withholding tax WHT rates Dividend interest and royalty WHT rates for WWTS territories Statutory WHT rates on dividend interest and royalty payments made by companies in WWTS territories to residents and non-residents are provided. Tax on loans secured on German property is not imposed by withholding but by assessment to corporation tax at 15 plus solidarity surcharge of the interest income net of attributable expenses. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8 of this treaty.

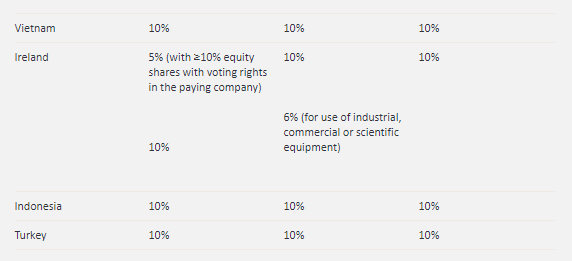

61 rows The rate is 10 for interest not described in the preceding sentence and paid i by banks or ii by the buyer of machinery and equipment to the seller due to a sale on credit. Corporate Capital Gains Tax Rate. The German federal government in January 2021 adopted a draft bill to modernize the provisions for relief from withholding tax and the certification of capital gains tax.

Germany - Tax Treaty Documents. The same provision applies to US companies holding real estate in Germany. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty.

You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. You claim a reduced rate of withholding tax under a treaty on interest dividends rent royalties or other fixed or determinable annual or periodic income ordinarily subject to the 30 rate. The rate is 15 10 for Bulgaria.

In all other cases the dividend tax is 15. Interest ccc Dividends Pensions and Annuities Income Code Number 1 6 7 15 Name Code Paid by US. Germany - Tax Treaty Documents.

This table should not be relied on to determine whether a US. German withholding tax at a rate of 15825 must be retained reported and paid to the federal central tax office by the licensee unless the licensor has received an exemption certificate based on. Branch office would have paid during the year if the branch had been operated as a separate US.

7For example Art 12 of the 2003 Japan-US tax treaty provides that The provisions. The rate is 49 for interest derived from i loans granted by banks and insurance companies and ii bonds or securities that are regularly and substantially traded on a recognised securities market. Global Withholding Taxes Summary of worldwide taxation of income and gains derived from listed securities as of December 31 2021 Carles Farre Principal International Tax KPMG US 1 212-954-1469 2021 Global Withholding Taxes Summary of worldwide taxation of income and gains derived from listed securities from 123 markets as of December 31 2021.

And second the treaty helps to promote residents of either country from avoiding taxes. The complete texts of the following tax treaty documents are available in Adobe PDF format. Withholding tax and capital gains tax.

30 for Germany and Switzerland for contingent interest that does not qualify as portfolio interest. The tax authorities can order a WHT of 15825 including solidarity surcharge if ultimate collection of the tax due is in doubt. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax.

Amounts subject to withholding tax under chapter 3 generally fixed and determinable annual or periodic income may be exempt by reason of a treaty or subject to a reduced rate of tax. Tax resident is entitled to the listed rate of tax from a foreign treaty country although generally the treaty rates of tax are the same. These treaty tables provide a summary of many types of income that may be exempt or subject to a reduced rate of tax.

Until ratification the withholding tax rate is generally 25. Corporate Income Tax Rate. Progressive rates from 14-45.

Over 95 tax treaties. Double taxation agreements between territories often provide reduced WHT rates. The treaty has two main goals.

In fact under a 2006 amendment to the US-Germany income tax treaty the governments of both countries are. The United States withholding rate on such dividend to German investors will remain at 15 percent. Us germany tax treaty withholding rates Sunday March 13 2022 Edit If Marks German tax liability on the 13500 is 1500 once converted from EUR the foreign tax credit of 200 will reduce his German liability to 1300.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents page. Most importantly for German investors in the United States the Protocol would eliminate the withholding. Provisions of the existing convention permit German resident investors to make portfolio investments in the United States through United States Regulated Investment Companies RICs and receive an exemption on the income in the Federal Republic.

Download the PDF Corporate Income Tax Rates 2018-2022. If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader.

What Is The U S Germany Income Tax Treaty Becker International Law

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

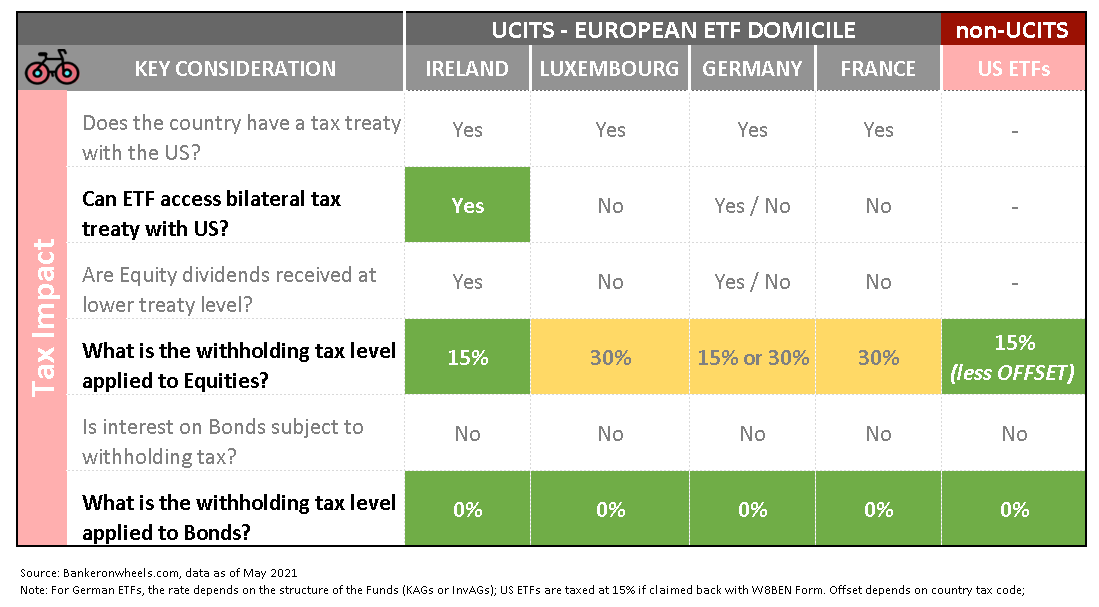

Easy And Boring Money How To Reduce Withholding Tax Bankeronwheels Com

2 Withholding Tax Rates On Royalties Paid To The United States Download Table

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Doing Business In The United States Federal Tax Issues Pwc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

German Law Removes Us S Corporation Tax Benefit

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

United States Germany Income Tax Treaty Sf Tax Counsel

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Guide To Taxes On Dividends Intelligent Income By Simply Safe Dividends